At the risk of sounding like Jimmy Carter, I felt a sense of malaise at this year’s commercial real estate summit. Last week, the Omaha conference reached its 35-year milestone under the guidance and creativity of the indefatigable attorney and developer, Jerry Slusky. Maybe it was the panel discussion that devolved into career counseling for young brokers by a grizzled veteran. Perhaps it was the lack of statistics on rental trends and square footage absorption, leading a developer to wanly muse about seeking out markets where “demand exceeds supply.” This revelation produced solemn nods and much chin-stroking from the pilgrims.

Lenders assured me that none of their loan books had the faintest whiff of distress, yet a panel on the subject implied otherwise. One general contractor told me that many of his clients in the southwestern portion of the US are going ahead with apartment projects “even though the numbers don’t work” because they know they are locking in today’s cost basis for the future. I had no response to this business plan. Using such logic, one could have made this justification to move forward on a real estate development at virtually any moment in the past 75 years.

It was the irascible Creighton economist Ernie Goss who brought out the wet blanket. I love an economist who is one-handed. There aren’t many. Dr. Goss gamely mixed John Maynard Keynes with Warren Zevon, befitting a professor who could pass for Bob Dylan’s cousin. Goss talked about the agricultural sector in gloomy tones. Corn at $4 a bushel is no bueno for Nebraska. His most sobering reminder was the chart showing that interest on the national debt now exceeds spending on national defense. No empires have survived this inflection point. All that Aztec bullion filled Spain’s coffers for two centuries before an overextended domain began to unravel in the late 1800’s. France sold its New World colonies to pay for Napoleon’s conquests. Lest one thinks such fate can’t befall the holder of the world’s reserve currency, it was Britain with her once-invincible pound sterling that was hobbled by two world wars and went cap-in-hand for an IMF bailout in 1976. George Soros heaped further ignominy on the beleaguered pound in 1992.

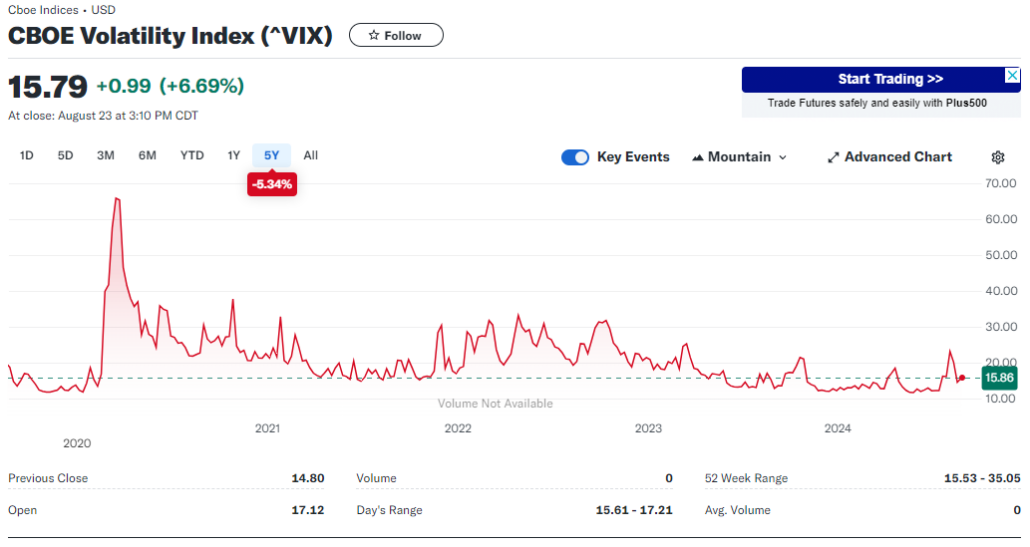

I can be prone to cynicism. It’s a blind spot, and an especially poor trait in a real estate developer where one’s raison d’etre is the rosy future. But I can’t help but feel there is a bit of the “end-of-the-Roman-Empire” feeling around. There’s bacchanalia galore with stock indexes hitting all time highs, private jets whisking families on vacation, the return of the Hummer, liquor lockers at private clubs, multiple country club memberships, CNBC masquerading as due diligence, billions of dollars in NIL money for college athletes, the de-facto legalization of THC and sports gambling, and Nebraska finally going all-in on it’s own casino gambling. Meanwhile, the low end of the income spectrum faces insurmountable home-ownership costs and pain in the grocery aisle. There are two wars being waged on the doorstep of NATO, a former president was nearly assassinated, and the current president all-but-admitted he was too senile to serve another term. And yet! And yet. What’s the VIX at? 100? Nope, try a benign 15.79. Credit continues to flow. Jerome Powell just declared victory. Game on.

You’re starting to ramble. Are you turning into an old man? Well, I don’t think of myself that way, but in actuarial terms the answer is unfortunately, “yes”. But there’s a place for old men. I’m not talking about ending up like Sheldon Levene in Glengarry Glen Ross. I’m envisioning Clint Eastwood here. Cigar and a Smith & Wesson. Let’s take another wise old Omaha guy I like – Warren Buffett. Berkshire Hathaway owns $235 billion of Treasury bills after significantly reducing holdings of Apple. Buffett may be old, but he’s not cynical. I can’t recall an annual meeting where the words “America’s best days lie ahead” weren’t uttered. However, in this instance, I prefer to watch what the man does, not what he says.

Dude, this is bumming me out, and your Hollywood references are beta. Let’s move along to that book you’re reading.

Ok. I’m about halfway through Nate Silver’s On the Edge: The Art of Risking Everything. It’s a fun read, but I think Silver could have used a better editor (pot, meet kettle). We follow his poker exploits, head down his sports betting rabbit-hole, take a tour of the venture capital industry, and then make an off-road excursion into the bizarre downfall of Sam Bankman-Fried. These are members of “The River,” Silver’s term for those who think in terms of probabilities and make wagers using their best estimates of positive expected value (EV). Yet, so much of what passes for rigorous evaluation of odds based on massive amounts of data often coalesces into little more than well-informed gut instincts. Silver seems to recognize this despite his continued attempts to explain most decisions in probabilistic terms. Take bluffing, for instance. Poker players smoke out a weak hand with a massive bet. Brute intimidation can often work better than the best statistical calculator. Venture capitalists are guilty of herd mentality and they have been conned by the likes of Adam Naumann and Elizabeth Holmes more often than they care to admit.

I am not a mathematician, and my knowledge of statistics is only good enough to read a Nassim Taleb book without a thesaurus. Nor am I a gambler. However, one character seems to be missing from Silver’s book – the 18th century Swiss mathematician Daniel Bernoulli. Silver relegates him to the footnotes. It was Bernoulli who first started to ask why people didn’t take certain bets, even though the probability might yield a positive expected value. Bernoulli figured out that the value of a bet was in direct proportion to the utility of the additional wealth to be gained. A rich man probably wouldn’t take long odds if it meant a major loss of capital, but a poor man has little to lose on a longshot. If you want a great discussion of Bernoulli and his role in finance, pick up The Missing Billionaires by Victor Haghani and James White.

Silver brushes right past Bernoulli’s revolutionary discovery. In a parenthetical aside, he writes “If you had a net worth of $1 million, would you gamble it all on a one-in-50 chance of winning $200 million and a 98 percent chance of having to start over from scratch? The EV of the bet is $3 million, but I probably wouldn’t.” Probably wouldn’t?!?! How about “no way”! Unless you are very young and have immense confidence that you can re-earn your million-dollar nest-egg, you’re not going to take that bet.

The marginal utility of wealth is critical to understanding the business wagers called “investments.” A venture capitalist on Sand Hill Road with $200 billion of assets under management will not agonize over staking $20 million on an AI-powered start-up that automates logistics in warehouses if it has a chance for asymmetrical upside returns. A solo investor with a net worth of $20 million would never take on such a venture alone, despite his or her immense personal wealth. Kahnemann and Tversky famously uncovered the psychology behind such thinking. Humans are risk averse. Most of the time expected pain of loss is greater than the appeal of a gain.

All of this talk of Bernoulli and wagering based on one’s wealth rather than simply the expected value of a bet reminds me of another Warren Buffett gem: When discussing the failure of Long-Term Capital Management which was headed by Nobel laureates and nearly brought markets to a standstill in 1998, Buffett remarked:

But to make money they didn’t have and didn’t need, they risked what they did have and did need. That is foolish. That is just plain foolish. It doesn’t make any difference what your IQ is. If you risk something that is important to you for something that is unimportant to you it just does not make any sense. I don’t care whether the odds are 100 to 1 that you succeed or 1000 to 1 that you succeed. If you hand me a gun with a million chambers in it, and there’s one bullet in a chamber and you said, “Put it up to your temple. How much do want to be paid to pull it once,” I’m not going to pull it. You can name any sum you want, but it doesn’t do anything for me on the upside and I think the downside is fairly clear. So I’m not interested in that kind of a game. Yet people do it financially without thinking about it very much.

I think we’ll leave it here for now. Coming soon… I have crunched some more numbers on Peakstone Realty Trust (PKST), and I think it trades at a 30% discount to it’s net asset value. You also get a 6% dividend while you wait. Elsewhere, Iron Mountain (IRM) seems to be infected with the same kind of data center hype that is artificially buoying the legacy data center stocks Digital Realty Trust (DLR) and Equinix (EQX) – companies that inflate their earnings by minimizing their depreciation and distorting operating cash flow by attributing far too much weight of capital expenditures to “growth” vs “maintenance”. Finally, I ran some numbers on Carnival Cruises (CCL) with the thesis that it would make a good short. It’s leveraged to the hilt. There were no COVID bailouts for cruise operators who are domiciled in tax-havens. Sorry, you can’t have it both ways. It seems I am wrong about CCL. Barring a major consumer slowdown (not entirely out of the question), the stock seems fairly valued. Until next time.