MASH was always full of laughs, but those CBS writers never let you forget about the senseless brutality of war. One minute the affable Colonel Henry Blake is on his way back from Korea to his wife and kids, the next minute he’s gone. Radar runs into the triage tent to tell everyone the news. Gut punch.

So goes Hollywood. Blake’s actor, McLean Stevenson, wanted more screen time. Fed up, he asked to be released from his contract in 1975. CBS obliged. I’m sure McLean Stevenson appeared in other roles. I can’t tell you what those were.

We don’t like to admit so much in life comes down to luck. It has to be skill, knowledge, expertise or “God’s plan”, right? There must be an explanation.

But sometimes luck really is the answer. Henry Blake lands in Tokyo. McLean Stevenson gets cast as Mr. Rourke on Fantasy Island.

Sure, you can put yourself into a lucky positions. Sam Zell’s father knew the Nazis were coming for his family. He prepared. He moved assets. He fled Poland. He also just happened to catch the last train out before the Luftwaffe bombed the tracks.

America has had a lot of lucky breaks. In the War of 1812, England was on the verge of reclaiming her colonies. Washington, DC was under siege by the British army. After the White House burned to the ground, a great tornado struck the Potomac valley. The British fled.

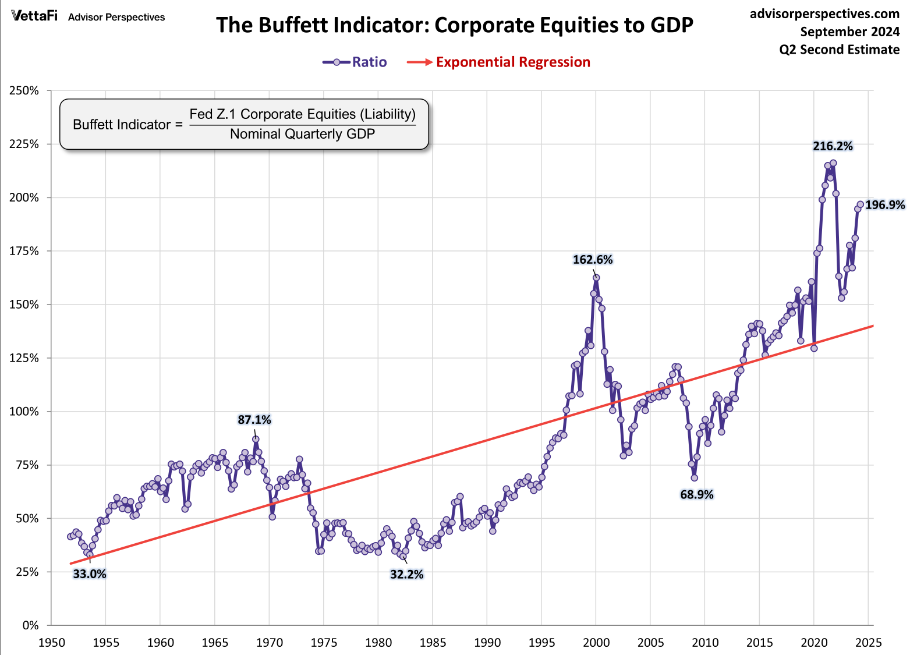

But we’ve gone too far. We’ve turned into a nation of degenerate gamblers. It’s not enough to go to a casino down the street or have an online sports betting app on your phone. You can trade memecoins! Just buy stock in quantum computing companies with no viable way to profitability. Or, you can roll your entire net worth into triple-levered Nasadq QQQ ETF’s. You’ll be fine. Stop-loss orders always get filled in a market panic.

That’s why value investing appeals to me. There is so much luck, chance and uncertainty involved in business. You can’t know the future. But you can hope to find companies that are selling at a price with a margin of safety – they appear to have some protection from downside; from bad luck and all of its cousins.

The most unlikely place to find good companies selling for reasonable prices is Hong Kong. As unbelievable as that sentence may read, it was not generated by Co-Pilot. Two weeks ago, I wrote about the bargain price for Johnson Electric (JEHLY), and briefly mentioned Budweiser APAC (BDWBY) and Sinopec Kantons (SPKOY). This week I am recommending WH Group (WHGLY).

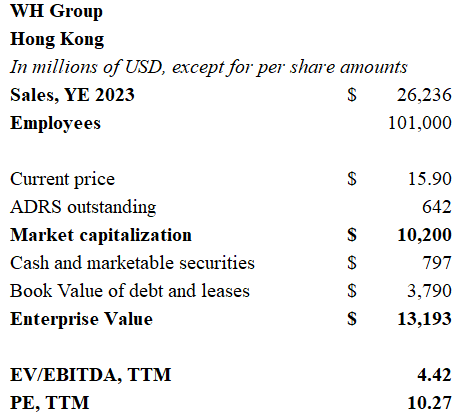

WH Group is the world’s largest producer of pork. The stock trades on the Hong Kong bourse and can also be bought over the counter at about $15.90 per share. The company had revenues of $26.2 billion in 2023 and $25.4 billion over the last twelve months’ reporting period through June of 2024. China and Europe accounted for 39% of WH Group’s 1H2024 revenues, and 46% of operating profits. The company was unfazed by the pandemic, instead it suffered it’s worst financial results during 2023 when pork prices in North America collapsed causing major inventory write-downs at the Smithfield division.

WH Group purchased the Virginia-based Smithfield for $4.7 billion in 2013. Now, WH Group plans to-relist Smithfield in a share offering. The projected value of the Smithfield operation is $10.7 billion. As part of the IPO, WH Group will reap about $540 billion in cash and reduce its ownership stake from 100% to 89.9%.

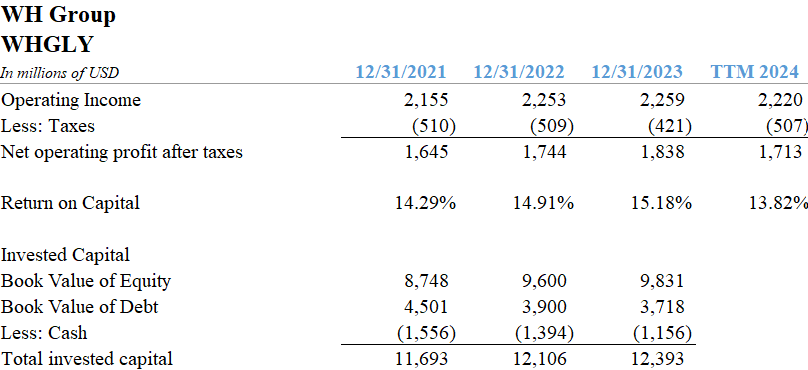

WH Group trades with a trailing PE of 10.4 times earnings and pays a substantial 5.6% dividend yield. The company is rated BBB by Standard & Poor’s, carrying a modest $3.8 billion of debt and operating leases with a weighted average interest rate of 4.4%. Gross margins are in the 19% range, with net margins above 8.5%. Returns on capital have been between 13% and 15% in recent years which seems noteworthy for a food processor.

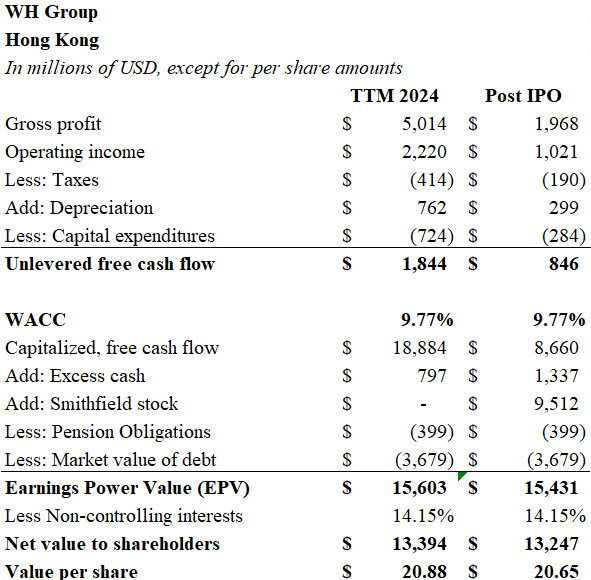

By my calculations, WH Group has more than 23% upside. Unlevered free cash flow for the company exceeded $1.8 billion over the trailing-twelve month reporting period. Employing a weighted average cost of capital of 9.77%, gives WHGLY a value of $18.9 billion. Adding $800 million of cash but subtracting the debt and about $400 million of pension obligations leaves an earnings power valuation of $15.6 billion. Adjusting for non-controlling interests, WH Group is worth about $13.4 billion, or $21 per American share. The effect of the Smithfield IPO is also presented below.

There are plenty of caveats. WH Group is listing its Smithfield operations because they have an opportunity to raise some cash, but the political optics are important. Distancing China from the US food chain is probably a well-caulculated move to insulate the company from US criticism. Second, WH Group has already run up by about 30% over the past 12 months. The really low-hanging fruit has been plucked. Finally, the Chinese economy is suffering a dramatic downturn as the property market hangover sets in. Consumers are in a frugal mood. Eating less pork may be a way for Chinese households to economize.

The Smithfield IPO will be a landmark moment for WH Group. If the North American operations receive a $10.7 billion stamp of approval by American investors, it could lead investors to ascribe a higher multiple to the Chinese and European businesses.

Until next time.

DISCLAIMER

The information provided in this article is based on the opinions of the author after reviewing publicly available press reports and SEC filings. The author makes no representations or warranties as to accuracy of the content provided. This is not investment advice. You should perform your own due diligence before making any investments.