We never found out whether Lawrence Wildman successfully turned around Anacott Steel. He sure was serious about it. You don’t drive all the way out to The Hamptons to make a deal with Gordon Gekko on a Friday night unless you’re serious. But did it work? Aside from Nucor, there haven’t been many happy endings for American steel companies. We’ll never know. My guess is that Sir Larry probably extracted some union concessions, sold some assets and limped along for a few years. Lakshmi Mittal probably bought Anacott a decade later for a pence on the pound.

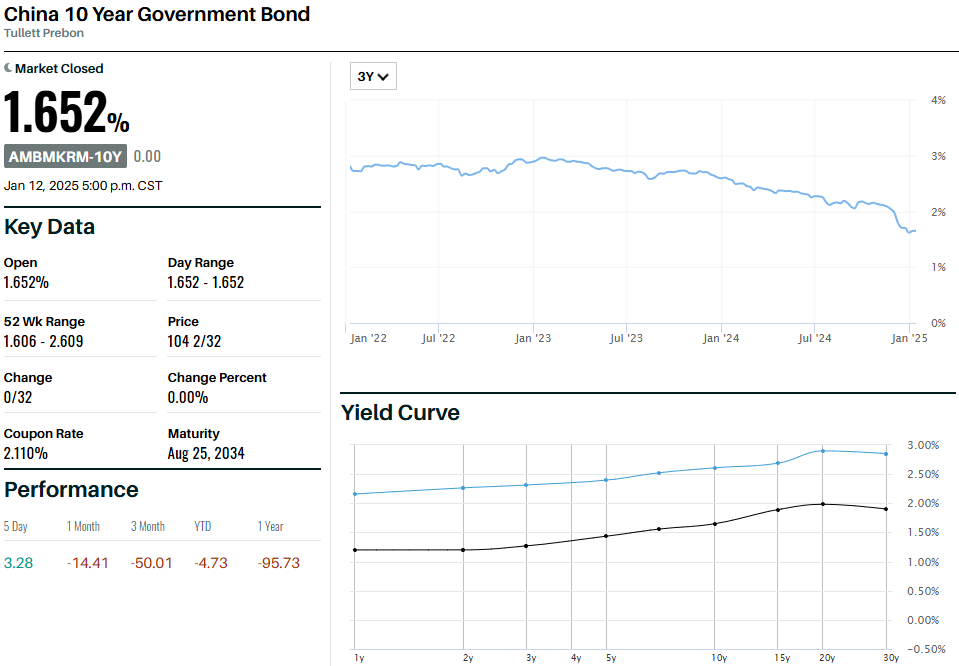

Of course, you can’t know the future. Wildman thought he was buying an industrial stalwart at a bargain price. He couldn’t have foreseen the collapse of the Soviet Union and the opportunists like Oleg Deripaska and Mittal picking over the crumbs of a failed industrial empire. They would produce steel in Eastern Europe at a fraction of Western costs. He couldn’t know that Deng Xiaoping was about to unleash one of the greatest economic miracles in modern history. Nobody in 1987 could have foreseen all the cheap Chinese steel that would eventually flood the market.

So it goes with investing. You have some theories about the future, you can find some businesses that appear to be selling for less than (or more than) their intrinsic value, you make some assumptions about interest rates, and there you have it. Only time will tell how the market weighs your decisions. Time can mean decades or minutes. There is no certainty.

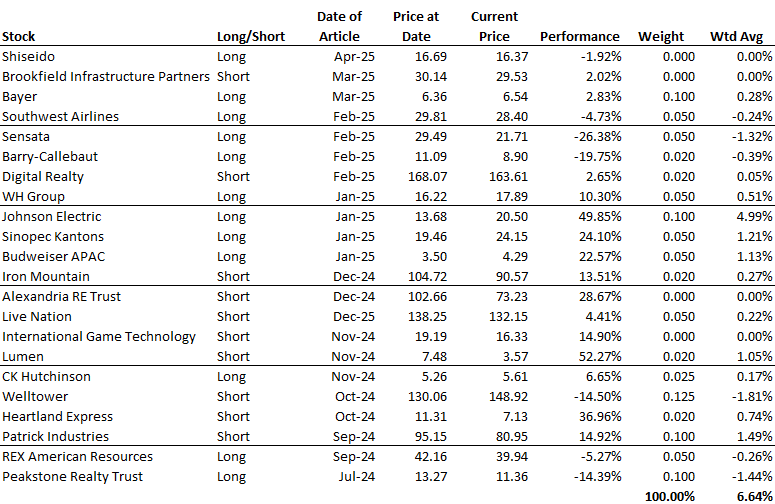

I decided to assess my own book of business. I’ve looked back over my articles since the summer of 2024 and charted the results. The results are decent. Since July 1 of 2024, the S&P 500 is up 2.67%, my selections have delivered a 6.6% return on a weighted average basis. It’s not exactly 1950’s Buffet performance, but it’s enough to keep me going.

I had two big misses in my “circle of competence” – real estate. I was long Peakstone Realty Trust (PKST) and short Welltower (WELL). I am convinced that Welltower is one of the most overvalued real estate businesses currently selling in the public markets. Guess what? Old Man Keynes’ axiom applies here. Nobody cares. It’s senior living and you can’t beat the demographic trends. Welltower will continue to dilute shareholders with more stock sales, overpay for B assets, deliver a paltry dividend yield, and people will keep buying the stock.

I’ve already moaned about Peakstone. They had been on a pretty good run. Paying down debt and liquidating weak assets seemed like a no-brainer. Then they went out and bought a bunch of B industrial at 5% cap rates. Didn’t see that coming.

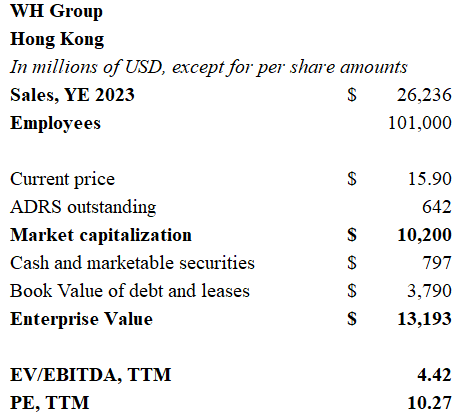

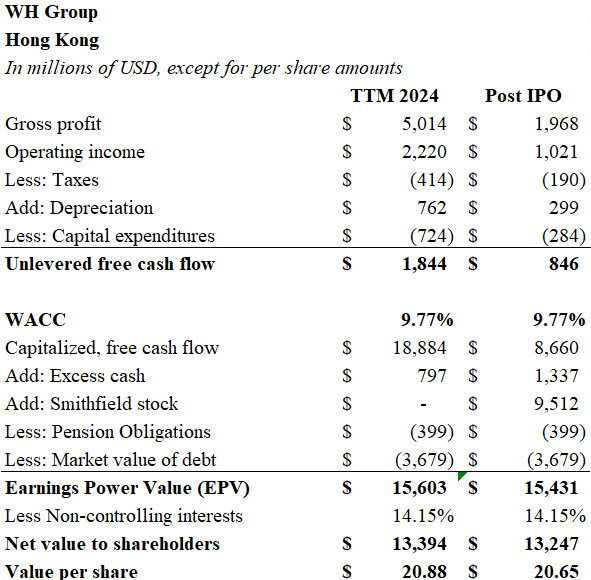

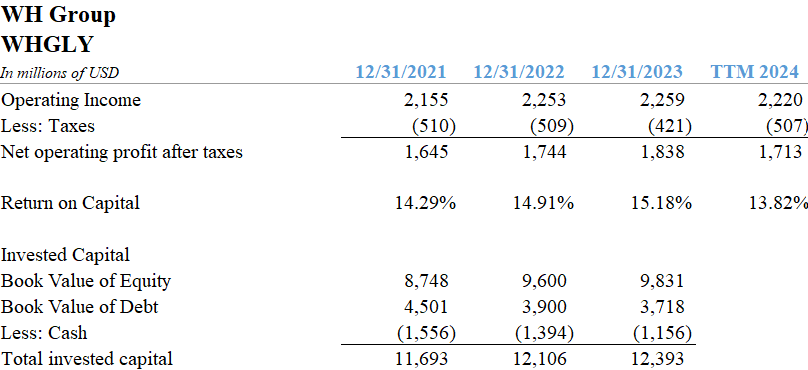

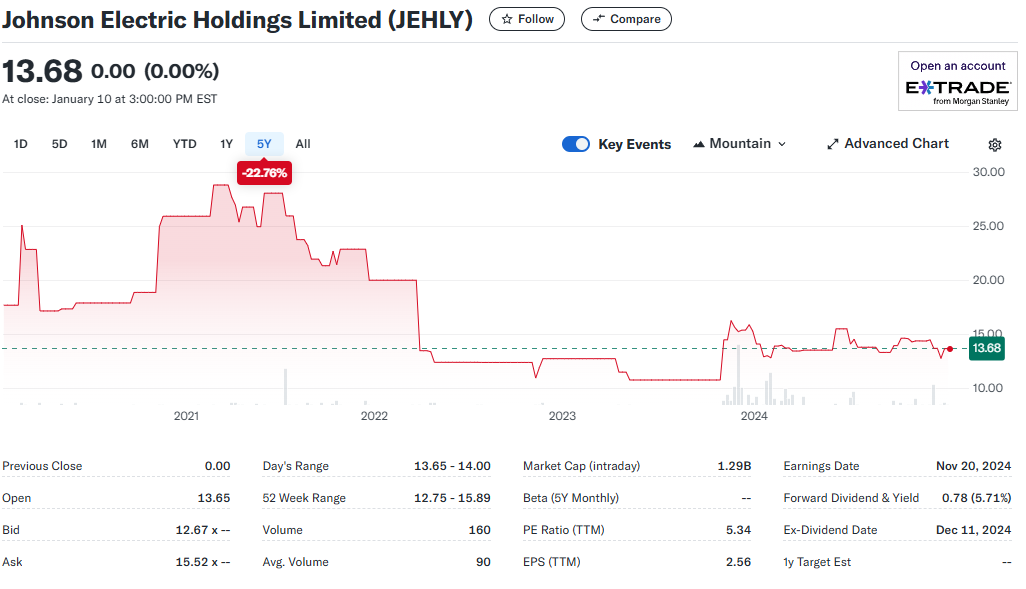

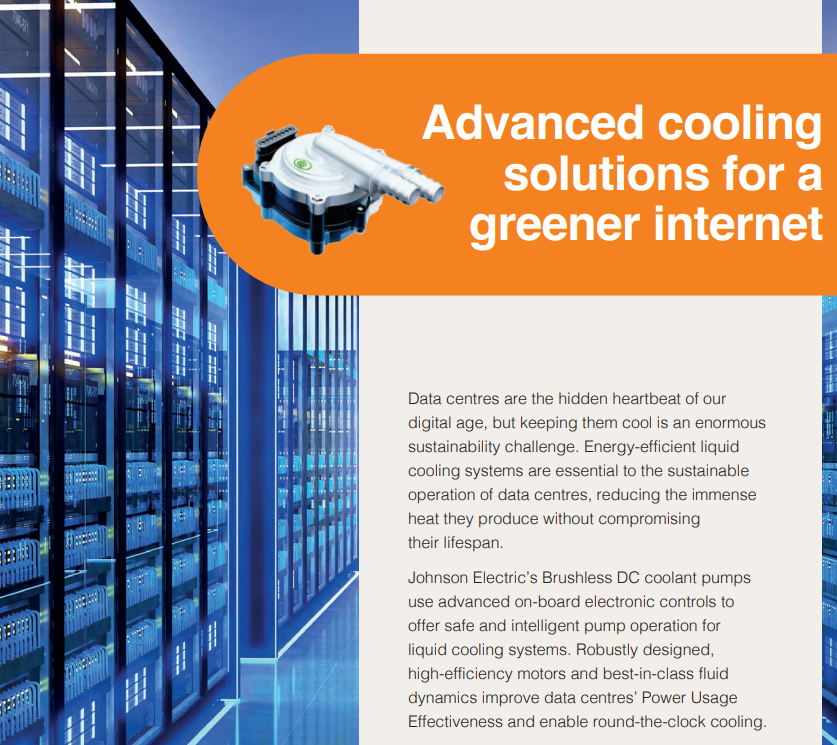

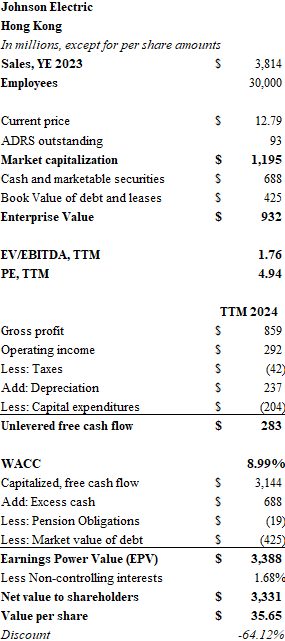

My biggest wins came from Hong Kong. I found exceptional bargains in January. I really did well with Johnson Electric, Budweiser APAC, WH Group, CK Hutchison, and Sinopec Kantons. I still own Budweiser, Hutchison and a little Johnson Electric. WH Group was sold after the tariffs were announced and Sinopec probably doesn’t go much further with oil below $65.

I had some decent luck shorting the AI capex boom. Lumen is down 50% and I also had nice profits on Digital Realty and Iron Mountain. I closed those shorts for some nice gains. They weren’t very large holdings, though.

There were four stocks in which I took no position. Shiseido has suffered from a decline in Chinese sales and poor margins, yet the stock is far from being a bargain. Learning my lesson from Welltower, I didn’t short Brookfield Infrastructure Partners. The company is an investment holding company that should trade closer to NAV, but it probably never will. Because, well… Brookfield. International Game Technology could have been a good short but I didn’t think it was worth the effort. I wish I had shorted Alexandria Trust. Biotech has been pummeled, and ARE is the industry’s biggest landlord.

My biggest disappointment has been following Elliott into long positions in Sensata and Southwest Airlines. Just because someone smarter than you has done something, it doesn’t mean that you should too. I had my doubts about Sensata, yet went ahead with the investment. Tariffs hurt, of course. My short position in trucker Heartland Express mitigated some of this fallout.

Finally, I am committed to Bayer for the long term. The company has the potential to improve margins, and I think RoundUp herbicide is indispensable. Patrick Industries is a long term short. A pandemic darling that has yet to fully capitulate. REX American Resources is an outstanding ethanol producer with no debt and disciplined management. It may be dead money for a couple of years, though.

By the way, Terence Stamp played Wildman in Oliver Stone’s film. A legendary actor, Stamp was fantastic as a cockney gangster in Steven Soderbergh’s 1999 film The Limey.

Until next time.

DISCLAIMER

The information provided in this article is based on the opinions of the author after reviewing publicly available press reports and SEC filings. The author makes no representations or warranties as to accuracy of the content provided. This is not investment advice. You should perform your own due diligence before making any investments.