Commercial real estate is under pressure. Hospitality properties are in distress and many retail assets are struggling amid restaurant closures and the acceleration of online shopping. Thus far, long-term leases and high-quality tenant rosters have spared Class A office properties from pain. Second quarter results for major publicly traded office real estate investment trusts offer insights into the office markets of large cities, and their discounted stock prices appear to be attractive.

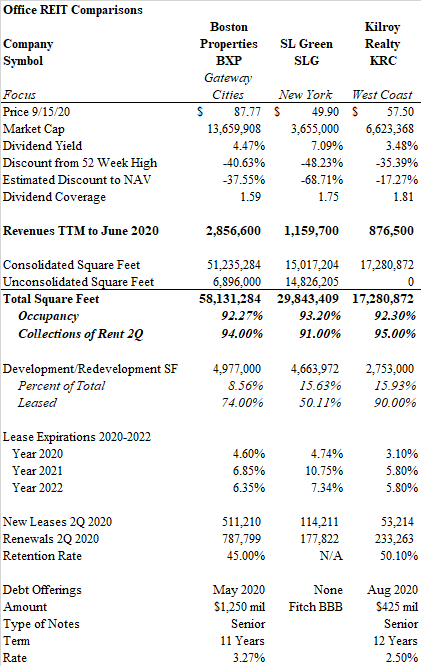

The second quarter results for three office REITs were reviewed for this report: Boston Properties (BXP), SL Green (SLG), and Kilroy Realty Trust (KRC).

Boston Properties is the nation’s largest office REIT with over 51 million square feet owned directly, and another 7 million owned through joint ventures. BXP has concentrations of properties in New York, Boston, Washington, D.C., Los Angeles and San Francisco. SL Green owns nearly 30 million square feet in New York City with roughly half-and-half split between direct ownership and joint ventures. SLG also holds nearly $1.2 billion of mortgages, mezzanine loans and preferred equity positions in other New York properties. Kilroy Realty Trust has over 17 million square feet based on the west coast. It has a larger suburban portfolio than the others, and its stock has performed comparatively well.

All office REIT executives believe their companies are well-prepared to weather the shift towards work-from-home arrangements. They have raised capital at low interest rates and bolstered their balance sheets. Lease expirations are minimal in the near term. Stocks are trading at considerable discounts to underlying asset values and offer hefty dividend yields. The ability to sustain dividend payments for the next two years seems likely and the discount to net asset values offers downside protection. Technology companies continue to lease new space. However, clouds hang on the horizon. A reduction in office floorplans seems inevitable. Financial firms may reduce headcounts as they reckon with tighter interest rate spreads and a rising collection of distressed assets in their portfolios. Meanwhile, working from home may not prove to be the revolution once envisioned in April, but certain jobs will remain permanently remote.

Note: This paper contains the opinions and interpretations of the author. No representations are made regarding the accuracy of the material. The views do not represent investment recommendations. All readers should perform their own due diligence before making an investment decision.

Occupancy and Collections of Rent in the Second Quarter

All companies collected over 90% of rents during the second quarter. BXP suffered from vacancy at its hotel properties, and both BXP and SLG reported rent collections only slightly better than 50% for their retail square footage. Yet office rent collections were better than feared. BXP and KRC collected 98% of office rents and 96% of SLG’s office tenants paid during the second quarter. Overall occupancy at the end of the June period stood hovered near 93% for all three firms. However, the actual staff presence in the buildings was minimal, with only about 10-15% physical occupancy for BXP and SLG and 25% for KRC estimated during late July.

Financing

BXP and KRC took advantage of the decline in interest rates to raise significant capital during the past six months while SL Green sold two assets for over $600 million to bolster the balance sheet. In August, Kilroy raised $425 million in senior notes at 2.5% due in 2032, and Boston Properties issued $1.25 billion in senior secured notes at 3.25% maturing in 2031. Kilroy raised $247 million in a March share offering. No new senior debt was issued at SLG, although a couple of properties were refinanced. Fitch did affirm a BBB credit rating for SL Green but revised its outlook to “negative”.

Shareholder Benefits

All CEO’s believe that their balance sheets are well-positioned for the next two years. Kilroy increased its dividend by 3% in August and SL Green purchased $163 million of stock during the second quarter.

Leasing Activity

Despite the pandemic, leasing activity did continue at muted levels. All three companies renewed about 1.5% of their portfolio with an approximate retention rate of 50%. BXP signed a major new lease for 400,000 square feet with Microsoft at its Reston, Virginia property. BXP and KRC have minimal lease expirations over the next three years with KRC at roughly 4% per year through 2022 and BXP closer to 6%. Kilroy has 85% of its space concentrated in low and mid-rise buildings. SL Green has minimal exposure in 2020 but faces a worrying 11% expiration level in 2021.

Kilroy and Boston Properties are bullish on markets where technology and life science businesses are showing resilience and even growth during the pandemic. While Facebook, Google and Amazon grab the most headlines, the emergence of laboratory needs in the biotechnology and pharmaceutical industry is equally fascinating. These companies are viewed as more likely to take up new space in coming years as the office environment remains necessary to foster collaboration and company culture. Both firms show interest in the Seattle market while BXP seeks further growth in the technology hotspots near the Los Angeles beaches. A notable bright spot during the doom and gloom of New York City’s pandemic challenges was Vornado’s signing of Facebook to a 730,000 square foot lease in the former post office building near Penn Station.

Development Activity

All three REITs have significant development activity which accounts for between 9-15% of the total square footage inventory for each company. While these developments pose risk should they fall short of targets, all CEOs noted that they had adequate liquidity to finish the projects. 90% of KRC’s pipeline is leased while BXP has 74% leased in their upcoming projects. SL Green has higher leasing risk, as was cited in the Fitch ratings downgrade, with 50% of new square feet committed. Among all three companies’ projects in development, the most prominent is the 77 story SL Green tower known as One Vanderbilt – a 1.5 million square foot building near Grand Central Station which is 70% leased and opens this week. The project is a landmark $3 billion asset. The opening generated enough excitement to propel the stock upwards by over 10%. SL Green is also partnering with a Korean pension fund on the $2.3 billion redevelopment of One Madison Avenue. The space is not scheduled for delivery until 2024. Kilroy is in a strong position with its development projects. KRC will soon be opening a 355,000 square foot building in Hollywood fully leased to Netflix and another 635,000 square foot building in Seattle 100% leased to a Fortune 50 company. Another 285,000 square feet in San Diego will come online in 2021 with 91% of the space leased.

Sublease Risks

One of the factors most likely to suppress future rents is the likelihood that surplus space is placed on the market by current tenants. These subleases become phantom vacancy that is nearly always offered at below-market rents. CEO John Kilroy did not view the subleasing environment as overly worrying. In reference to San Francisco in particular, he offered, “Sublease space in the market right now is about 5 million square feet… 2.3 million was added during Covid… to put that into perspective, the direct vacancy rate in San Francisco right now is about 5.4% and sublease is 2.5% of that. To compare that to the dot-com bust, direct vacancy was 8.3% and sublease space with 6.8%.” However, despite the CEO’s comments, Kilroy identified sublease space in its 10-Q, the first time in several quarters such information was broken out. 849,000 square feet in the portfolio was listed for sublease, or nearly six percent of the portfolio. About half the space was noted as vacant. In late July, DropBox announced it would list 270,000 sf for lease, nearly 1/3rd of its offices, in the newly opened Kilroy development in Mission Bay, San Francisco. Meanwhile, Boston Properties was impacted by the bankruptcy of Ann Taylor’s parent company which occupies 340,000 sf in Times Square. It would seem likely that even if a bankruptcy restructuring is successful, surplus space will find it’s way onto the market.

SL Green Challenges

SL Green is the most difficult office REIT to analyze. Nearly half of the company’s square footage is held in joint ventures which are not consolidated in the operating revenues and expenses. The company also has a complicated portfolio of first mortgages, mezzanine loans and preferred equity positions in various properties in New York. SLG also owns many properties encumbered by ground leases.

Indeed, some mezzanine loan positions appear to be under pressure. On September 2nd, it was reported that SL Green bought the $90 million first mortgage for 590 Fifth Avenue after Thor Equities defaulted on a $25 million mezzanine note. The property is a 19 story 100,000 sf building. The mezzanine business cuts both ways for SL Green. A distressed developer who falls behind on their mezzanine financing could present an opportunity for SL Green to pick up assets for the value of the first mortgage. In most cases, these will be bargain acquisitions. Unfortunately, the impairment of a mezzanine loan is in itself a damaging blow to the balance sheet and the need to muster capital to protect a junior debt position could require deeper pockets than the company anticipates.

While two asset sales reinforced cash positions, the failed $815 million sale of the Daily News Building in March offered an indication of the challenges valuing New York office assets in a post-pandemic world after Deutsche Bank pulled financing for the deal. SLG was able to refinance the property in June with a $510 million mortgage from a lender consortium. SL Green is also considering the sale of its two multifamily properties.

Investment Evaluation

SL Green has seen its stock hammered by the pandemic. Down by nearly 50%, SLG’s dividend yield exceeds 7%. Boston Properties has faced a 40% decline and offers a yield of 4.4%. Meanwhile, Kilroy lost 35% since its pre-Covid highs and yields 3.45%

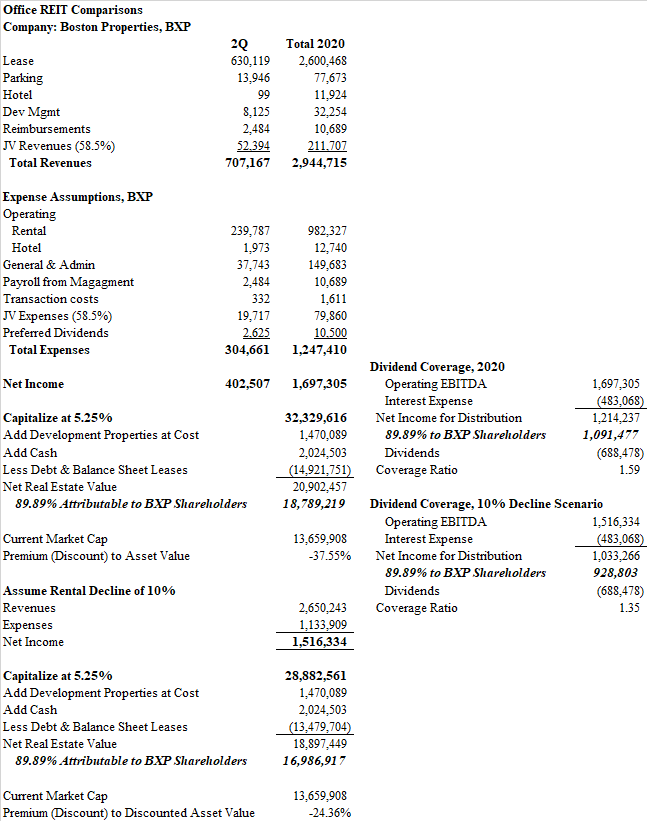

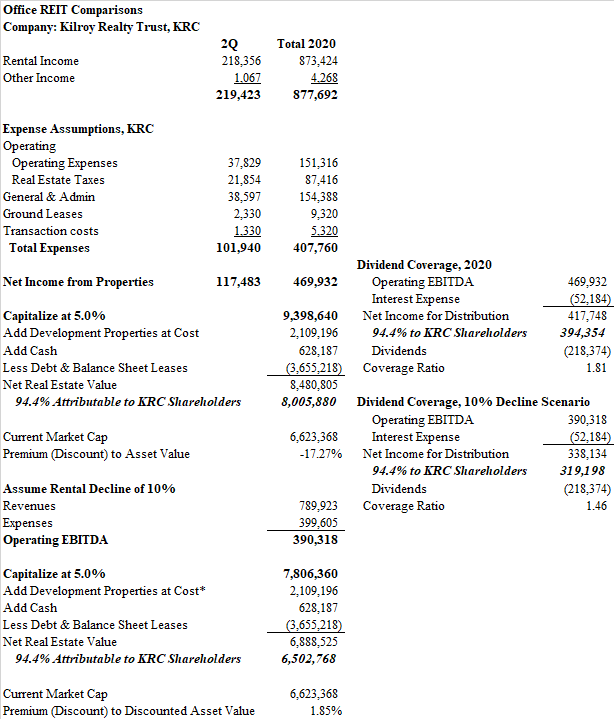

In the process of evaluating the stocks, I made simple assumptions. Some may argue that these are too elementary, but the exercise was intended to discover whether the public market is significantly undervaluing the underlying assets by a wide enough margin to provide an element of downside protection. I was not intent on arriving at a precise valuation of the businesses.

My method was to annualize pro forma income simply by taking second quarter revenues and multiplying them by four. This may prove generous in the event further occupancy problems arise; it also is punitive for the companies. For example, the methodology assigns no future income for the Mission Bay/DropBox property placed in service. It also ignores the 70% occupancy of One Vanderbilt placed in service by SLG. It gives no value to the new BXP leasing in Virginia. In all cases, the exercise merely values the development assets at cost. The only upside “help” that was given by the author was a slight uptick in hotel revenues attributed to BXP during the balance of two quarters.

I capitalized the net income at 5.0% for KRC due to its high level of low and mid-rise buildings, 5.25% for BXP, and 5.5% for SLG. Certainly, before the pandemic, these cap rates would be considered high for trophy office properties in major urban areas. I added the cash on the balance sheet and subtracted debt to arrive at a net asset value. All in-progress development projects were added at cost. Joint venture assets were included in the income statement computations to the extent that they were reflected in the ownership percentages. The result is a 70% value discount for SLG, and a 38% discount for BXP. KRC is selling for a 17% discount. On the income side, I calculated the dividend coverage ratios: BXP stands at 1.6x, SLG 1.7x and KRC 1.8x.

Next, I performed a stress test analysis that reduced revenues by 10%. In the case of SL Green, I also deemed their property loan portfolio to be 50% impaired. Even with this penalty, SLG appears to trade at par to net asset value. Meanwhile BXP would seem to be 24% below value as well. KRC with its under-estimated future income looks to be valued at par after the stress test. In this example, BXP and KRC could continue to comfortably fund their dividends but SLG would be under pressure to reduce shareholder payments.

Paradigm Shift

While all three companies trade at steep discounts, one can’t help but wonder if the world will look back at this moment and ask why real estate experts underestimated the paradigm shift of working from home. If it worked pretty well for 6 months for most office workers, why can’t it work permanently? If nothing more, workers got 1-2 hours of their days back by not facing a long commute into the city center. This increase in productivity alone is tangible.

Of course, as the weeks have dragged on, frustration has set in with the arrangement. JP Morgan CEO Jamie Dimon has summoned traders back to their desks and recently noted a decline in productivity among employees at the banking giant. Zoom meetings can’t replace the 80% of communication that occurs through body language, and even a micro-second lag on a call is maddening after the third time someone interrupts. The office is a vital asset in our knowledge and information-based economy. Ideas and culture are the engines of growth. But data entry, call centers, accounting and routine back office functions seem to need nothing more than a good workstation in the den along with a high-speed data connection. Office leases will take 2-5 years to expire, but what if all companies simply reduced their footprints by 10%? My stress test may prove to be too light.

Conclusion

Kilroy and Boston Properties are the most appealing investments. The balance sheets have been fortified and leasing activity for the companies’ new developments is robust. Kilroy’s exposure to suburban markets offers a hedge against central business districts in major cities, and BXP has a well-diversified geographic portfolio. Meanwhile, despite the steep discount, SL Green appears to be the riskiest of the three REITs. The concentration in New York City is worrisome. While some may argue that the risk is reflected in the added discount, it is worth noting the SL Green executives had been appealing to investors as recently as the fall of 2019 that the stock traded at an unjustified discount of 25% to its peers. A risky mezzanine portfolio and the complexity of its joint venture arrangements could pose future challenges.

The most encouraging future for office properties lies in the technology and life sciences industries. Despite recent sublease announcements, Both Kilroy and Boston Properties are aggressively pursuing these vanguard companies with visible degrees of success. Meanwhile, the transformation of New York City into a technology hub is well under way. The question is now raised: can technology employment grow fast enough to replace the shrinking office needs of remote workers?

Bert Hancock, September 15, 2020

bert@alchemydevelopment.com

Appendix: Exhibits

I have listened to the second quarter earnings conference calls for three of the largest apartment real estate investment trusts: Equity Residential Trust (EQR), AvalonBay Communities (AVB), and Mid-America Apartment Communities (MAA). Together they own over 250,000 apartments. I was struck by the generally positive tone in spite of our troubled economy. I have assembled a research report that you may find interesting.

If you’re pressed for time, here is the HEADLINE:

Using reasonable assumptions, apartment REITs are currently trading at discounts to the underlying value of their assets. In my estimation, at the current moment, purchasing a liquid security with low debt backed by the best multifamily properties in America yielding 4% is a better prospect than buying an apartment complex yielding 6% with 75% leverage.

LEASING MOMENTUM, DECENT RENT COLLECTIONS, LOWER TURNOVER

All three REITs reported collections from April to June that were ahead of projections made during the crisis moments of March. All experienced a decline of about 2% on collected rents. The unemployment insurance program and $1,200 stimulus checks certainly helped. Our experience in the Omaha metro area has been similar. Collections declined by 1% during the April-June period and even lower during July in our area. Executives claimed that June and July leasing activity had returned to 2019 levels. Resident turnover was 2-3% below the same period in 2019.

CAPITAL IS CHEAP

All companies took advantage of low interest rates. AvalonBay issued $600 million in bonds at 2.5%, Equity Residential received a $495 million secured loan at 2.6%, and Mid-America issued $450 million in senior secured notes at 1.7%. All companies have healthy cash positions and exhibit better credit ratings than during the 2008-09 recession. AvalonBay felt confident enough to authorize a $500 million stock buyback program. Low rates were not entirely a favorable factor: AvalonBay and Mid-America each noted that occupancy was hindered by home purchases driven by low interest rates. This trend has also been evident in our market.

CONSTRUCTION STARTS SUSPENDED

All three companies have cancelled new development projects with expectations of weakened rent growth and a belief that construction costs will decline as most commercial and hospitality projects are suspended indefinitely. AvalonBay had noted that construction costs in major coastal metros have declined by 5-7%.

URBAN PROBLEMS vs SUBURBAN SUCCESS

Equity Residential and AvalonBay have the majority of their portfolios located in major metropolitan areas on the coasts. The contrast in performance between urban and suburban markets was profound. AVB and EQR have 33% and 25% of their units in urban central business districts, respectively. Equity Residential and AvalonBay faced difficult headwinds in their urban properties. New leases in urban areas posted rent rates as much as 8% below earlier quarters, and renewal rents dropped by 1%. Vacancy levels approaching 9% were reported in central business districts of San Francisco, Boston and New York. The increase in work-from-anywhere employment has been compounded by a loss of foreign workers and college students in these areas. EQR noted that while 4% of revenues are attributable to commercial tenants, only 60% were paying rent – an ominous sign for central business district retail performance.

Executives at EQR and AVB were encouraged by positive summer leasing trends at their suburban communities. New lease activity was strong enough to help overall company-wide occupancy levels exceed 94%. Overall, company-wide quarterly revenues were down 2.4% at EQR and roughly flat at AVB.

SUNBELT SATISFACTION

Mid-America operates assets in the sunbelt: The Dallas metro, Atlanta, Nashville, the Carolinas, and Austin all feature prominently in their portfolio. MAA executives were ecstatic with their results. Effective rents for new leases at MAA were up 3.4% for the quarter. Occupancy exceeded 95%. Overall revenue for the quarter was up 1.4% over 2019 at MAA. Executives were confident that migration trends toward sunbelt metros would continue, and had seen evidence of acceleration.

INVESTMENT OPPORTUNITY?

All three companies are trading well below February levels. EQR trades at a 40% discount to the February high, AVB is down 34% and MAA is 20% lower. Meanwhile, EQR and AVB sport dividend yields in excess of 4% and MAA has a yield of 3.4%. In a world of zero percent Treasuries, the dividends are appealing.

The three apartment giants appear to be trading at a discount to their net asset values.

I present a table on the attached pdf comparing the three companies. Some of you may take issue with my simple methodology, but I think the calculations fairly portray a set of businesses that may be undervalued. For annualized revenues, I doubled the first half of 2020. Executives generally opined that markets had stabilized, so I am taking their remarks at face value. I included a $50 per unit capital reserve in my estimates to arrive at a pro forma net operating income level. The results show that all three companies have adequate dividend coverage between 1.38x for EQR to 1.78x for MAA.

I employed a 5% capitalization rate to arrive at a value. Some could argue that this is a low number on a risk-adjusted basis, but as the cost of funds drifts below 3% the cap rate seems reasonable. Cap rates in space-constrained urban markets were well below 5% heading into March. The results indicate that public market discounts to net asset values range from 6% for AvalonBay to 20% for Equity Residential.

Finally, I reduced my revenue assumption by 5% to determine the impact on values and dividend coverage. In this exercise, all three were comfortably able to maintain their shareholder distributions. Current share prices were roughly in line with net asset values in this example.

There is no question that the pandemic will continue to negatively impact the economy. Indeed, it will be interesting to see if MAA bosses are less optimistic on the next call as Covid cases sweep across the south. I do believe there will eventually be meaningful negative impacts on white collar employment that has thus far been spared the brunt of the layoff pain. Could revenues decline by 10%? It is very possible. I do not subscribe to the conventional wisdom that “everybody needs a place to live, so apartments will be just fine”. Young professionals under the age of 30 can find their parents’ homes just as welcoming as they did during the 2008-2012 period. However, I do believe much of the downside risks have been reflected in the current share prices. These three companies boast some of the finest apartment assets in North America. Their balance sheets are strong and the dividends are well-covered.

Please let me know if you have any comments or criticisms. I am interested in all perspectives. A disclaimer: These numbers represent my opinions and should not form the basis of any investment decisions.

Let’s hope for a vaccine. Take care.

Rural Nebraskans suffered from heavy flooding this past March, so the IRS allowed residents of many counties to extend their filing deadline to July 31st. As we wind down this uniquely painful tax season, it’s time to reflect on what has been a most unpleasant set of surprises unleashed upon many real estate investors by the The Tax Cuts and Jobs Act of 2017.

The tax reform law was a boon for corporations. It reduced the average tax rate from 29% to 21%. Pass-through entities such as limited liability companies (LLCs) and S-Corporations also stood to benefit from certain deductions, the most common of which included a 20% deduction on net income. Although the law had been passed in 2017, much of the guidance was written throughout 2018 and even into early January of 2019.

When the dust settled earlier this year, it became apparent that the new law contained limitations on deductions that sent accountants and property investors scrambling for cover.

Real estate owners have been able to use depreciation charges to shelter taxable income. Depreciation is the non-cash expense that owners are allowed to deduct from operating income which represents the deterioration of a physical asset as it ages. In the case of apartments, the standard method is to divide the asset cost (excluding land), by 27.5 years and deduct that amount from reported net income on an annual basis. On a $1,000,000 building, the annual deduction is around $36,400 per year.

Real estate owners are also allowed to deduct mortgage interest from net income (principal can not be deducted). Therefore, many real estate partnerships, especially in the early years of operation, reported negative earnings to the IRS once depreciation and interest were subtracted from operating income. Individual investors with passive income from other investments were able to shelter this income with losses from real estate.

The 2017 law essentially invalidated the ability to report a net loss to the IRS for most real estate partnerships.

As of tax year 2018, if an apartment building runs a net loss after depreciation charges and interest deductions, it is thus deemed to be a “tax shelter”. Consider the words tax shelter to be the accountant’s equivalent of a football referee seeing a questionable call on the field and requesting a video replay review. Once the net loss was evident under prior accounting principles, accountants presented their clients with one of two choices: Either switch to an alternative depreciation schedule (ADS) of 40 years instead of 27.5 years, or limit interest deductions to 30% of net operating income. The new rules mean that ability to generate a reported loss to the IRS has all but vanished. Sheltering passive income with passive losses from real estate is now virtually impossible.

In fairness to Congress, their intention was good: reduce the desire for investors to maximize leverage in order to maximize the deductibility of interest. By reducing the tax benefits of heavy borrowing, you reduce risk in the system.

Here’s rough sketch of what taxable income looked like before and after the tax reform law:

Under the old law, a taxpayer actually reported a loss to the government. Today, the investor makes a choice. In Option 1 where the depreciation charge is reduced under a 40 year schedule, the tax would be about $2,000. In the second case where interest expenses in excess of 30% of net income are added back, the tax is around $3,500. The Tax Cuts and Jobs Act of 2017 is actually a tax increase for many leveraged partnerships.

Which option would you choose? The longer depreciation term looks more appealing, however there are two caveats: Once you elect to take the ADS, you can never go back. Second, the interest deductibility limitation is painful in the short run, but those unused interest deductions are carried forward and can offset future income. So, an investor with a longer perspective may opt for the interest limitation. A last note of caution: the interest deductibility limitation gets even more strict in 2021. During that tax year the deduction is limited to 30% of net income AFTER depreciation.

There are several very important loopholes in this law. The most egregious example is that a pass-through partnership with limited partners that do not exceed a 35% ownership threshold are exempt from the deductibility limitations. This clause unfairly penalizes pass-through companies with a high number of partners.

Now, before we conclude, I have to provide you with this disclaimer: I am not a tax expert. My examples are very generic and are purely for illustrative purposes. You absolutely should not rely on this information and you must consult with a tax professional for guidance.

So, does real estate still offer tax benefits?

Yes. The ability to deduct depreciation and interest may not be as generous as in years past, but they are still deductible. Depreciation is particularly beneficial because it is a non-cash charge. Tax advantages remain, but the noose has been tightened.