It just doesn’t matter

I had a thesis: The pandemic boom in camping and water sports is over. Find a stock that didn’t get the memo and sell it short in the hopes of making a profit on the decline. I thought I had found such an overpriced nugget in the form of Patrick Industries (PATK), an Elkhart, Indiana maker of a lot of stuff that goes into recreational vehicles, recreational boats, and recreational powersports. It’s fairly, um, recreational, and therefore totally discretionary. They also have a division that makes parts for the housing industry.

The days of social distancing are over. Camping and water sports had an incredible two-year run. Remember “glamping”? That seemed to pass from our lexicon faster than ayahuasca at a sweat lodge. Thor Industries (THO), one of the biggest RV makers, saw sales increase from $8 billion in 2020 to over $16 billion in 2022. Thor will do well to exceed $10 billion in 2024. Meanwhile, Patrick’s stock price put the hammer down on Thor. PATK is up 273% over five years and 90% over the past twelve months. Is Patrick a stock that I would sell short? No.

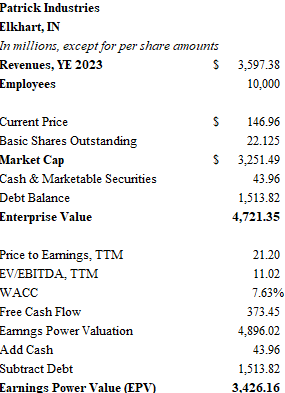

Patrick will have sales of about $3.6 billion in 2024. It trades at about 21 times earnings with a market capitalization of $3.2 billion. The enterprise value to EBITDA multiple for PATK is 11 and the company generates over $350 million in free cash flow per year. Most importantly, Patrick seems to be pretty good at acquisitions, spending about $1.8 billion over the past six years. Take Sportech, for example. Patrick acquired the company in January for $315 million from a private equity firm.

Sportech, of Elk River, Minnesota generated revenue of $255 million in 2023. Based on the pro forma numbers in the Patrick 10-Q, it looks like Sportech generated about $26 million of EBITDA during the first six months of 2024, so it seems like Patrick paid a multiple of around 6 times EBITDA. The public markets give Patrick a multiple above 10 times EBITDA, so presto-chango you have a nice return on the investment without doing any heavy lifting.

Now, if you take out Sportech, the results at Patrick for the first half of 2024 were flat-to-down. Net sales excluding the acquisition would have been $1.8 billion for the first six months of 2024 which is slightly below the levels of 2023. The acquisition machine needs to keep rolling at Patrick in order to keep the shares elevated. This seems possible – Patrick may offer a sanctuary for beleaguered suppliers to the RV and marine industry. If the boom is over, Patrick may be able to swoop up some more acquisitions at bargain prices.

Just for grins, I decided to conduct a rough valuation of Patrick using steady-state income and capitalizing the free cash flow by the weighted average cost of capital. Bruce Greenwald would call this an “earnings power valuation”. I employed a weighted average cost of capital of 7.63% on free cash flow of $373 million to arrive at a value of $4.9 billion. Subtracting debt of $1.5 billion and adding cash of $43 million results in an EPV of $3.4 billion – roughly in-line with the current market cap.

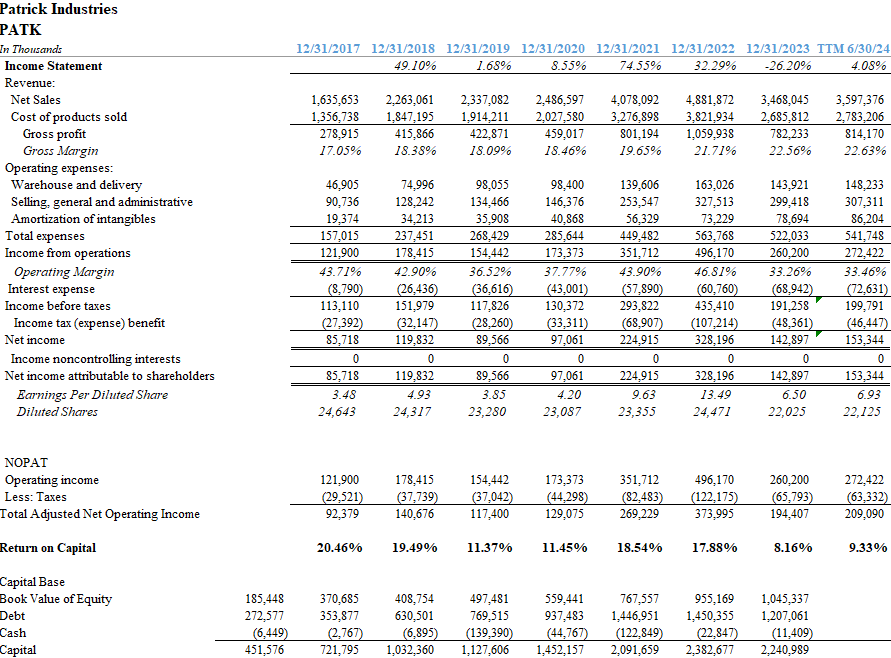

Shorting a stock requires a steely certainty that the company is either a. An unsustainable bubble, or b. Engaging in some kind of accounting deception. Patrick meets neither criteria. Do, I think Patrick could be heading down the road of making unwise acquisitions simply to paper over underlying weakness in the core business? It’s possible. Returns on capital have dwindled (see appendix) to the high single-digit levels. Is that the result of overpaying for some businesses, or simply the cyclical trough the industry faces? Hard to say, but I wouldn’t try to bet against management.

Right on cue, the RV industry received a jolt this morning with the release of a report by Hunterbrook Media accusing Winnebago (WGO) of selling defective RVs and a looming warranty crisis. PATK dropped about 3.5% on the news. It may be something. Or not.

Tripper: Important announcement – Some hunters have been seen in the woods near Piney Ridge trail and the fish and game commission has raised the legal kill limit on campers to three. So, if you’re hiking today, please wear something bright and keep low.

Appendix: Patrick Industries operating results 2017-2024 TTM to June 30 with associated returns on capital.