Control

Louis XIV was a control freak. The “Sun King” reigned from 1643 to 1715. The king’s day was timed to the minute to allow the officers in his service to plan their own work accordingly. From morning to evening his day ran like clockwork, to a schedule that was just as strictly ordered as life in the Court. “With an almanach and a watch, one could, from 300 leagues away, say with accuracy what he was doing”, wrote the Duke of Saint-Simon.

When it came to rigorous discipline, the King’s finance minister was equal to his master. The legendary Jean-Baptiste Colbert brought fiscal responsibility to a kingdom that was nearly bankrupt at the start of the 1650’s. Colbert, a relentless workaholic, introduced a system of government accounting that was the first of its kind. Spending was brought to heel and tax collections were enforced.

Colbert is often credited with laying the foundations of the modern French state. He centralized government power and introduced mercantilist policies which included investments in infrastructure and academies for the sciences, engineering and arts. Colbert raised tariffs on manufactured imports like Venetian glass and Dutch textiles and promoted French industry.

Although modern France recognizes Colbert’s fiscal innovations, few mourned his passing in 1683. The French taxation system was notoriously regressive, with nobles and clergy being exempt. Peasants, laborers and business owners were taxed heavily. Even many noblemen despaired at Colbert’s reforms. Oral testimony was no longer allowed for verification of one’s noble status. The rolls of noblemen were purged as those of the highest caste were required to provide documentary evidence dating back more than 100 years.

In modern finance, the lack of control can lead to all sorts of complications. Take Live Nation (LYV), for instance. Live Nation owns Ticketmaster and produces over 44,000 live music and events around the world each year. Yet, during the first nine months of 2024, only 60% of earnings were attributed to shareholders. The company owns and operates venues through a series of joint ventures with local promoters and facilities owners. These noncontrolling interests have a claim on 28% of net income.

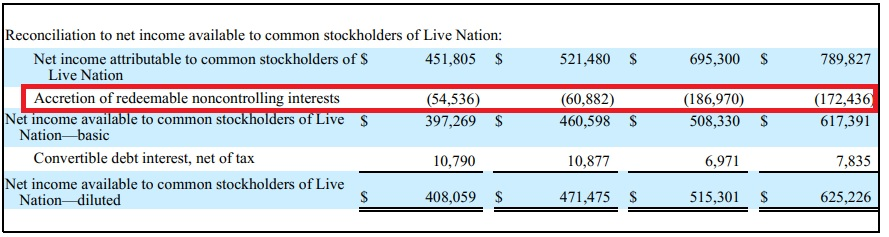

There are also redeemable noncontrolling interests that have a claim on company earnings. These are opaque arrangements with promoters that have the ability to sell their interests back to the parent company using a put option. The problem with these put options is that their costs are variable in nature – the more the company earns, the larger the option premium gets.

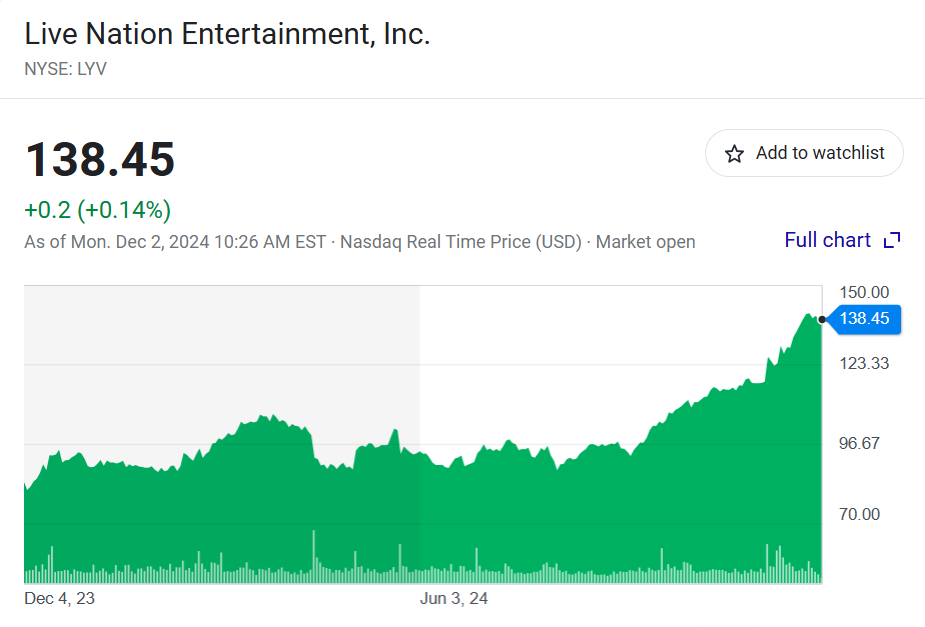

These redeemable noncontrolling interests are shown on the balance sheet as a liability, but because they can increase in value over time, this “accretion” is also deducted from earnings per share. For the nine-month period ending September 30, 2024, earnings amounted to $849.2 million. Subtract the share for noncontrolling interests, and $695.3 million was left. Or was it? Earnings per share should have been $2.95, but the accretion of redeemable noncontrolling interests for the period meant that only $2.18 was attributable to shareholders. This means that LYV is trading at 160 times earnings for the trailing 12-month period.

Live Nation seems to be overvalued by as much as 54% once deductions are made for noncontrolling interests. I am not even factoring in the possibility of anti-trust litigation for monopolizing the ticket industry. While such enforcement seems less likely under the Trump administration, much risk remains.

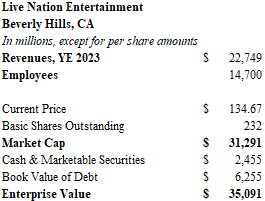

Live Nation posted $23.3 billion in revenues over the trailing twelve-month period. There are massive margins in tickets. Ticketing accounts for about 12% of revenues, and 37% of operating income. The venue operations, on the other hand, are capital intensive and only generate 5% margins. To make matters worse, growth seems to have peaked. With the conclusion of the Taylor Swift tour and the post-pandemic surge fading from view, revenues declined by over 6% in the third quarter. Aside from the excitement around the Sphere (SPHR) and a few major tours, many concerts have struggled over the past year.

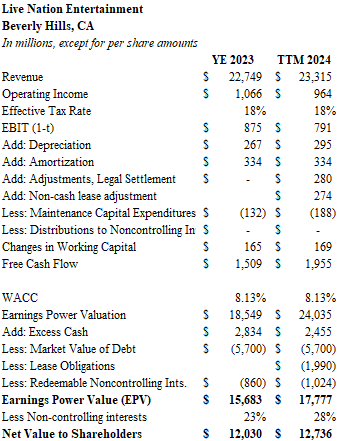

Below is my earnings power valuation for Live Nation. I calculated an equity value of $12.7 billion versus the current market capitalization of $31.3 billion. I applied a weighted average cost of capital of 8.22%. This factor includes $6.3 billion of debt with an S&P rating of BB, or an imputed debt cost of 5.85% under current yields and spreads.

Is my discount rate too high? Perhaps. But even if you use 6%, the equity value sums to $18.8 billion. Should I factor in something for growth? Maybe. But there doesn’t seem to be much near-term growth. In the long-term, growth will come from more venue developments and leases – a business which generates poor yields on capital. There’s a reason why most venues are built with taxpayer funds: the economics rarely work. No amount of U2 and Adele concerts can save The Sphere from an eventual bankruptcy filing.

I am also being pretty fair with how I treat the redeemable noncontrolling interests. I do not deduct anything from earnings. Instead, I have deducted the $1 billion book value shown on the balance sheet after operating income has been capitalized. Finally, I only make a deduction for maintenance capital expenditures of $188 million. In reality, the future capital commitments for the firm are much greater.

It was said that between 3,000 and 10,000 courtiers visited Versailles on a daily basis for a chance to mingle with the Sun King. If only Colbert had Ticketmaster in his day.

Until next time.