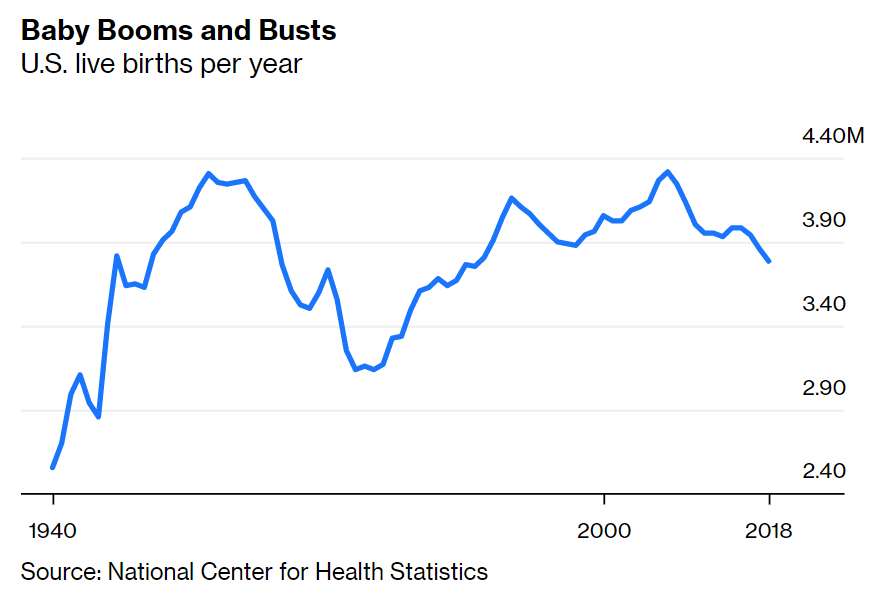

The Covid19 pandemic has caused distress in hospitality and retail assets, but apartments have largely been spared. However, a subset of the multifamily sector has been placed under pressure: student housing. University enrollments had already been declining steadily over the past 8 years and the pandemic has accelerated the decline. Indeed, demographic trends foretell an ominous future around the year 2026 as the peak level of children born in 2008 pass through college. High school graduations will peak in 2025.[1]

University enrollments have declined by 1.8% nationally according to the National Student Clearinghouse Research Center. Generally, enrollment is better than many had feared in April with enrollment posting gains at many public four-year institutions. Meanwhile, enrollment at many private institutions has dropped significantly. International enrollment is down 11.2%. Although student participation is better than expected, the prevalence of virtual learning means that many campuses are ghost towns. The loss of international tuition and housing revenue has added to government budget cuts to produce a shortfall in higher education that exceeds $120 billion by some estimates. For further reading, Michael Nietzel at Forbes has a grim look at the budget cuts hitting colleges across the country. I recommend his articles.

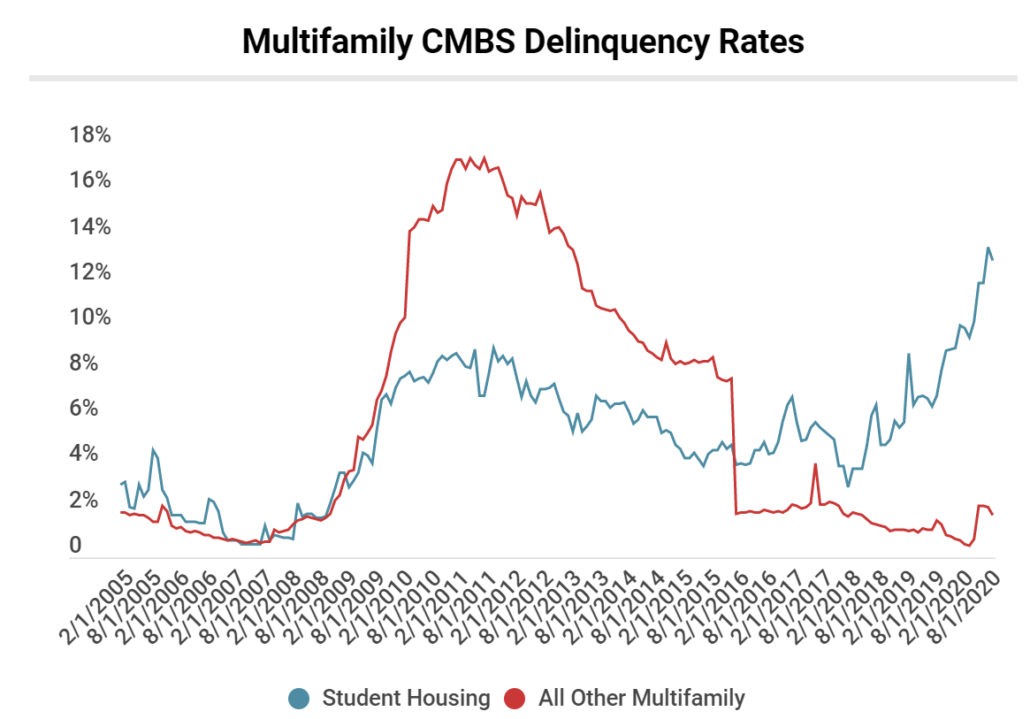

The pressure on universities translates into a rough environment for student housing providers. With empty rooms at many campuses, mortgages secured by the housing are now among the rising list of economic casualties. Commercial mortgage-backed securities secured by the loans to student housing complexes have shown a significant increase in delinquencies.

Source: Trepp Research

Trepp Research has highlighted the Wolf Creek Apartments in Raleigh, NC which serves North Carolina State University and The View at Mongomery serving Temple students in Philadelphia as two of the largest distressed assets, with $43 million and $83 million mortgage balances outstanding respectively.

Fitch Ratings had already warned about the possibility of an oversupply of student housing in 2016:

“Even prior to the pandemic, student housing was identified as a subsector of concern in the Fitch-rated CMBS 2.0 universe since 2016, due to the greater performance volatility and operational expertise required compared with traditional multifamily. Both student housing occupancies and property-level net operating income (NOI) performance have lagged traditional multifamily.”

In addition to supply concerns, Fitch noted that student housing carries the added risk of nearly 100% annual resident turnover and higher maintenance expenses.

While many retail and hospitality properties may never

recover from the pandemic, student housing will likely rebound. However,

long-term demographic trends will mean that universities will need to find ever

more creative ways to boost enrollment and fill housing.

[1] Justin Fox, Bloomberg, May 30, 2019. Fox relies heavily on the work of Nathan D. Grewe, an economics professor at Carleton College and his landmark study: “Demographics and the Demand for Higher Education”.