No Show

Many years ago, when I was in high school, my Dad gave me some scholarly advice that paid dividends in subsequent years. He said that if I was stumped on an essay question, then the best thing to do was to “show what I know”. I may not have all the facts about the Battle of Antietam, but I might be able to muster some pretty decent paragrpahs about why Abraham Lincoln demoted General George McClellan. “Show what you know” snatched mediocrity from the flames of academic despair on several occasions.

That’s where I’m at this week. I don’t have any new conclusions, but I can tell you a few of my thoughts and observations. Here’s to showing what (little) I know…

Peakstone Realty Trust (PKST)

Oh Peakstone, you broke my heart. Last fall, I thought I found the ideal REIT trading at an enormous discount. Peakstone was priced in the $14 range and had a market cap of $480 million. The office and industrial REIT owns some prime property like the Freeport McMoRan tower in downtown Phoenix, Amazon distribution centers, and the McKesson office complex in Scottsdale.

I threw a ludicrous cap rate at the office space and figured the real estate was still worth about $1.7 billion. After subtracting net debt of $936 million, I thought the stock was worth $18. Plus it had a 6% yield.

We’re now 40% lower, and that stings. A lot. All management really had to do was buy back stock, sell assets and pay down debt. When your dividend is yielding 6%, it’s a no-brainer. Instead, deal junkies do what deal junkies gotta do. Deals, y’all. In November, they went out and re-levered the balance sheet in to buy a $490 million portfolio of outdoor storage real estate at a cap rate of… 5.2%.

I did not have buying B industrial assets with negative leverage on my bingo card, but there you go. The website photos on Peakstone’s portfolio page now look like the opening credits from Sopranos.

Barry-Callebaut (BRRLY)

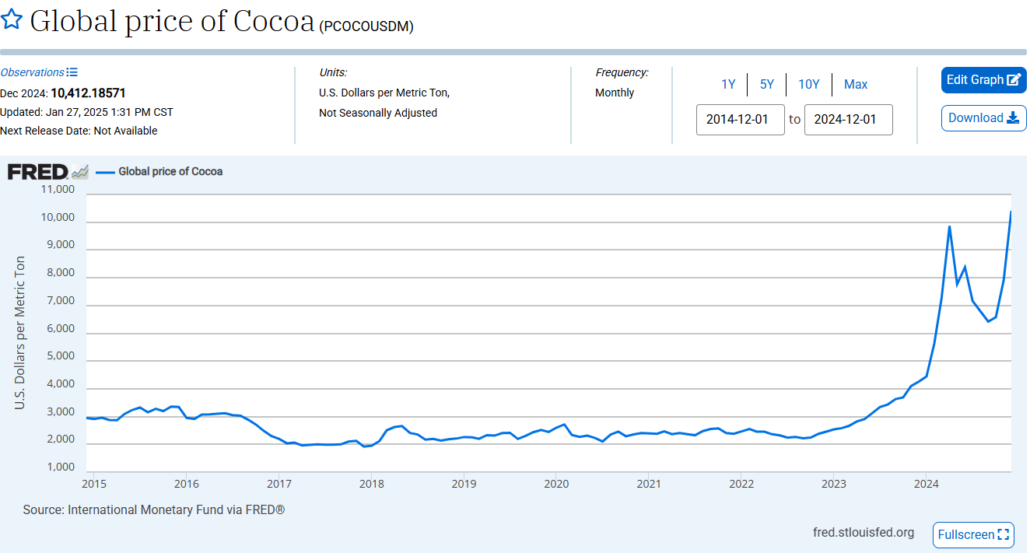

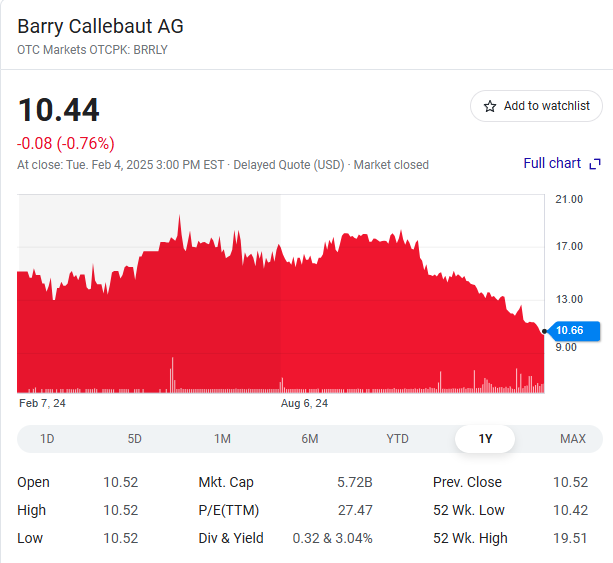

The Zurich-based refiner and seller of chocolate has taken an absolute beating as the price of cocoa has skyrocketed. Shares are down 50% over the past year. I’ve never seen anything quite like the price chart for cocoa. Parabolic is an understatement. It’s actually mind-boggling.

Crop failures in Ivory Coast and Ghana have led to a shortage. But is it really that bad? There’s got to be an opportunity here somewhere. Surely futures markets are way over their skis?

Barry-Callebaut is one of the leading suppliers to confectioners, and they have a dynamic new CEO who has begun an efficiency drive. The problem is that Barry-Callebaut had to purchase inventories of cocoa at massive discounts to the contracted sales prices to their customers.

Working capital looks like an absolute trainwreck. The company spent over 2.6 billion CHF on cococa inventory over the past year. In order to cover the loss, BRRLY turned to the debt markets and raised about 3 billion CHF. Eventually, the cocoa market’s gotta rebalance, right?

Digital Realty Trust (DLR)

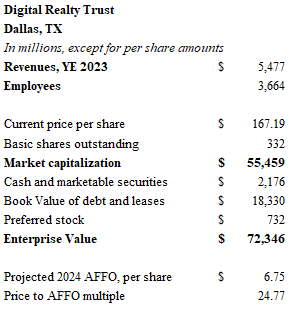

The sector is so hot right now. An Australian fund manager, Nate Koppikar, is shorting data centers in the belief that supply of will outstrip demand as this whole AI-thing bursts its bubble. I have looked at Digital Realty in some depth. I don’t have much of a smoking gun here, but I do agree that the market is way ahead of itself.

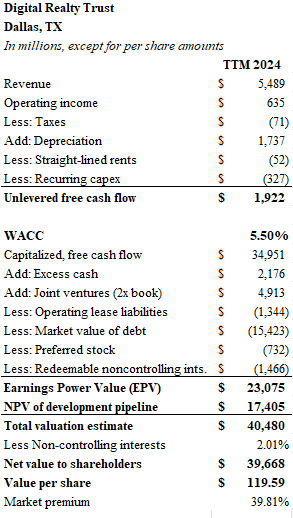

Digital Realty trades at 24 times projected funds from operations and carries an enterprise value of $70.4 billion. I produced a cocktail napkin set of numbers and my conclusion is that the stock trades at a 40% premium to its intrinsic value.

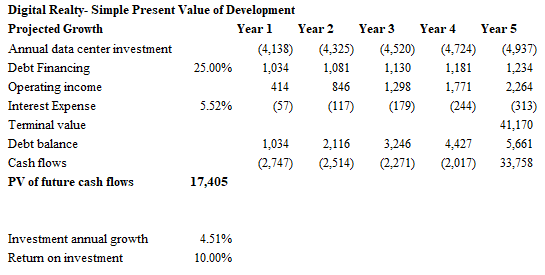

I took the most recent unlevered free cash flow of $1.9 billion and applied a cap rate of 5.5%. This results in an asset value of $35 billion. I subtracted debt, redeemable noncontrolling interests, preferred stock and added joint venture investments at 2 times book value. Next, I ran a very basic discounted cash flow on a future investment pipeline that essentially doubles the company’s real estate footprint in five years. I assumed 25% leverage for the new properties. The present value of future development amounts to $17.4 billion. The sum of these pieces is an estimate of net asset value of $39.7 billion.

Obviously, this is a work in progress, but here are my general observations thus far: REITs must distribute 90% of their taxable income. Therefore, it is very difficult to achieve growth through the reinvestment of profits. DLR pays a dividend yield near 3%, and this leaves virtually zero cash to deploy into new data centers. DLR must, therefore, raise external capital in order to grow. I assumed that they continue to borrow 25% of their future investment requirements. The rest needs to come from the issuance of new stock. Indeed, during the first three quarters of 2024, Digital Realty raised $2.7 billion by issuing new shares.

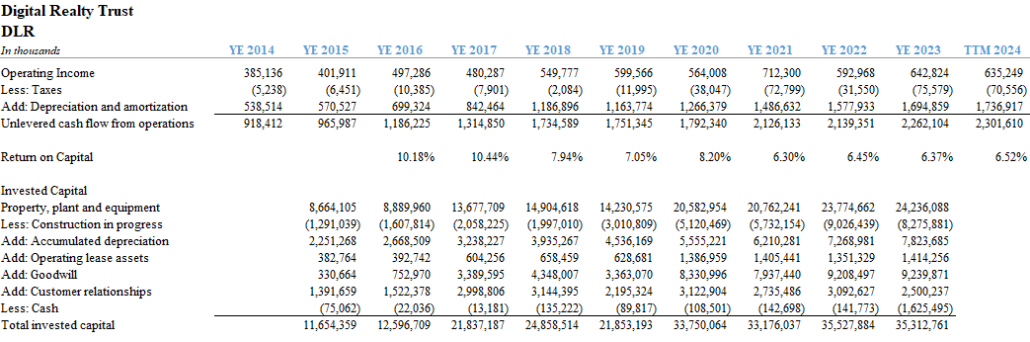

Raising cash through the sale of stock to deploy into profitable real estate developments works just fine as long as the return on capital exceeds the cost of capital. In this regard, DLR’s recent track record has been unexceptional. Returns on capital have hovered near 6.5%. In my future development scenario, I assumed returns of 10%. This is what their major competitor Equinix has been able to achieve. DLR has been able to produce shareholder value despite unremarkable asset performance because they loaded up with debt at the absolute bottom of the COVID-era interest rate bonanza. The weighted average cost of the $17.1 billion of loans outstanding is a puny 2.9%. Unfortunately, the incremental debt for the development program will have an interest rate in the 5% range.

At this point, I don’t have a strong conviction about the value of Digital Realty. My projections are too simplistic to be relied upon. But I do believe that the stock reflects a future development pipeline that must be executed flawlessly and at returns much higher than the company has a achieved in recent years. REITs that can issue stock, and deploy the cash at returns in excess of the cost of capital work very well. When they don’t deliver those returns, they become shareholder dilution machines. I’m going to leave it here for now.

Until next time.

DISCLAIMER

The information provided in this article is based on the opinions of the author after reviewing publicly available press reports and SEC filings. The author makes no representations or warranties as to accuracy of the content provided. This is not investment advice. You should perform your own due diligence before making any investments.